45 risk of zero coupon bonds

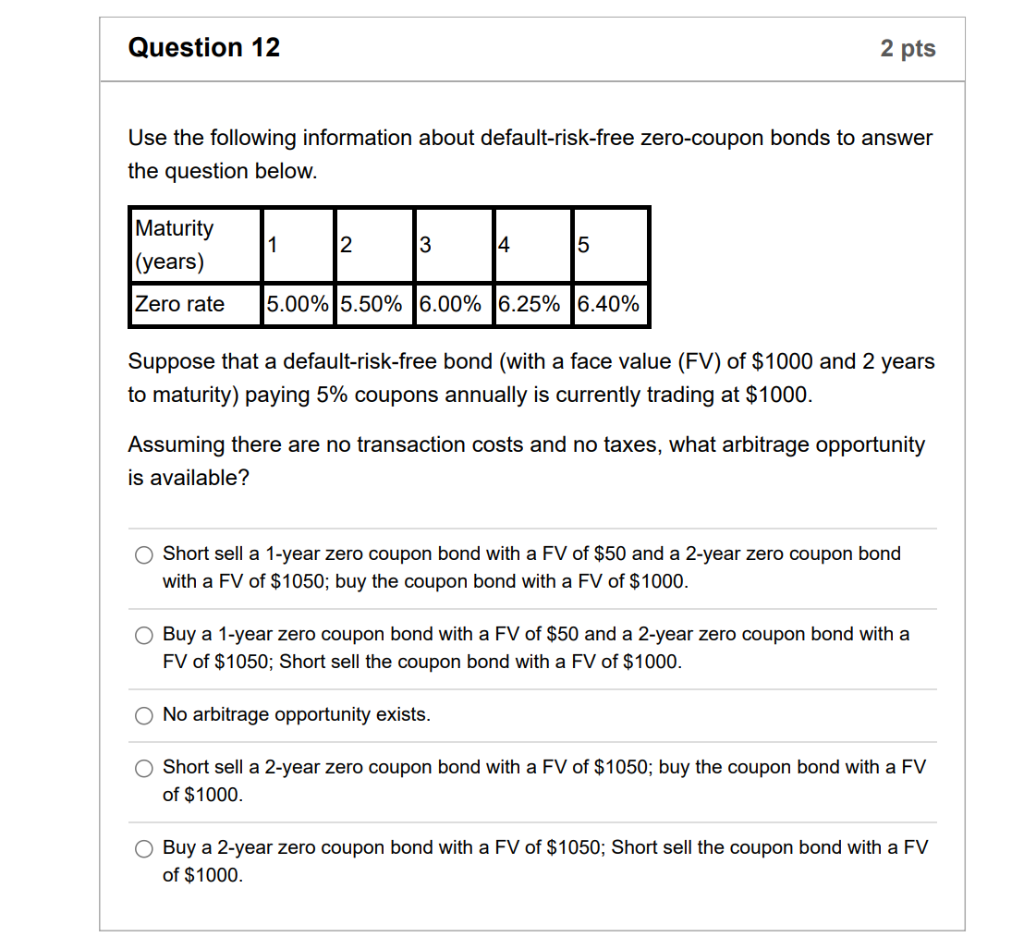

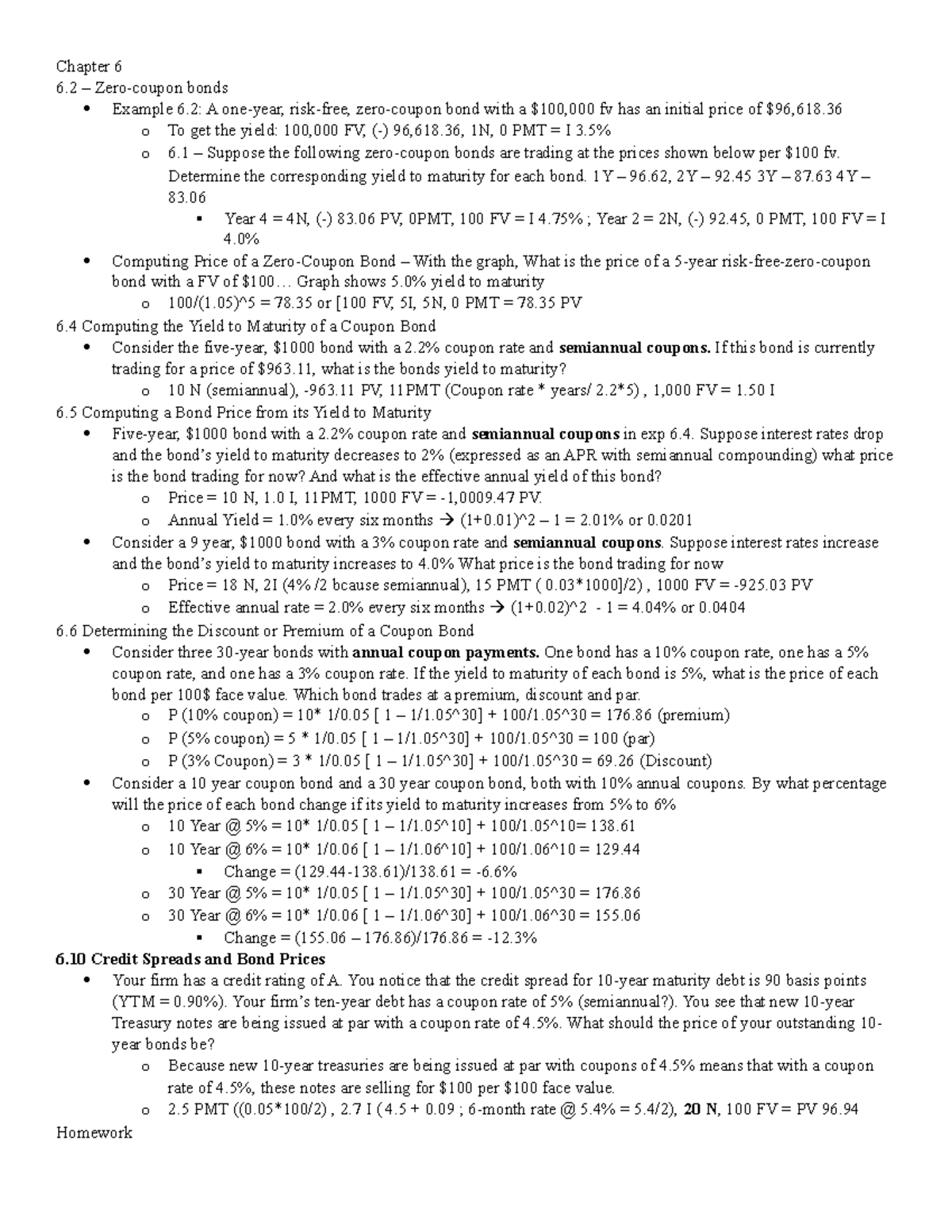

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Corporate zero-coupon bonds are usually riskier than similar coupon-paying bonds. If the issuer defaults on a zero-coupon bond, the investor has not even received coupon payments,...

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... From an investor's perspective, zero coupon bonds have the following advantages: They are safe investment instruments and have a lower element of risk involved. Long Dated zero coupon bonds are the most responsive to interest rate fluctuations. Therefore, it might be profitable for the bondholder in the case of a long duration (a higher 'N').

Risk of zero coupon bonds

Zero-Coupon Bonds and Taxes - Investopedia The zero-coupon bond has no such cushion, faces higher risk, and makes more money if the issuer survives. Zero-Coupon Bonds and Taxes Zero-coupon bonds may also appeal to investors... Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Fixed returns: The Zero Coupon bond is an ideal choice for those who prefer the long-term investment and earn in a lump sum. The reason behind this is the assurance of a ... Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

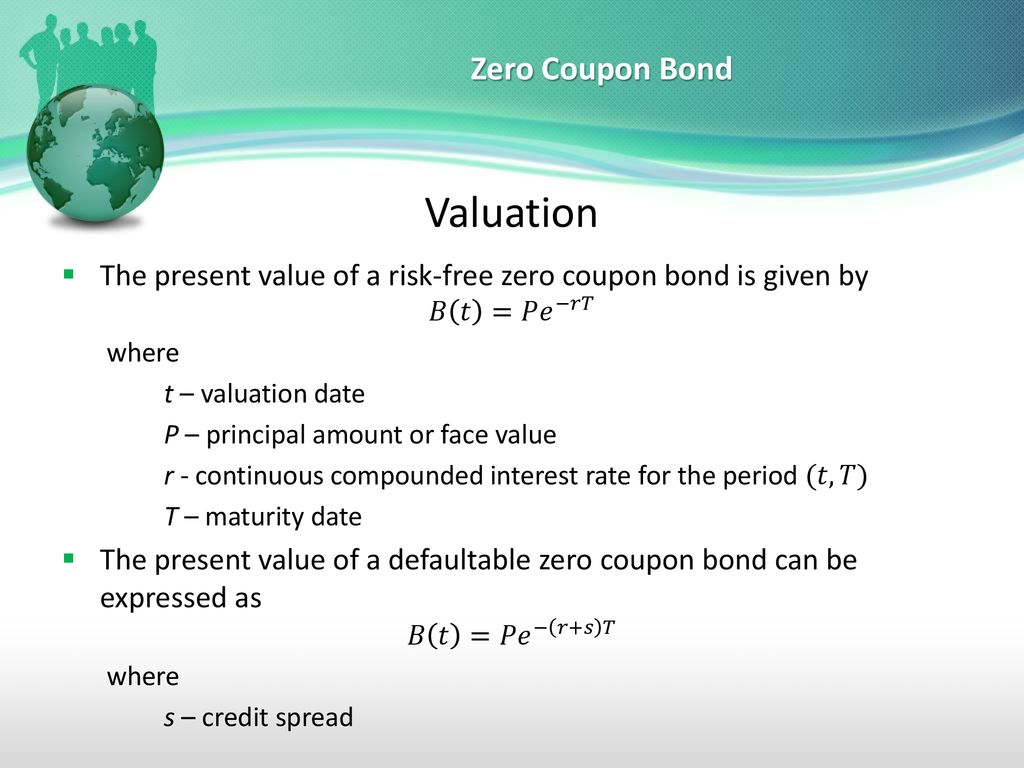

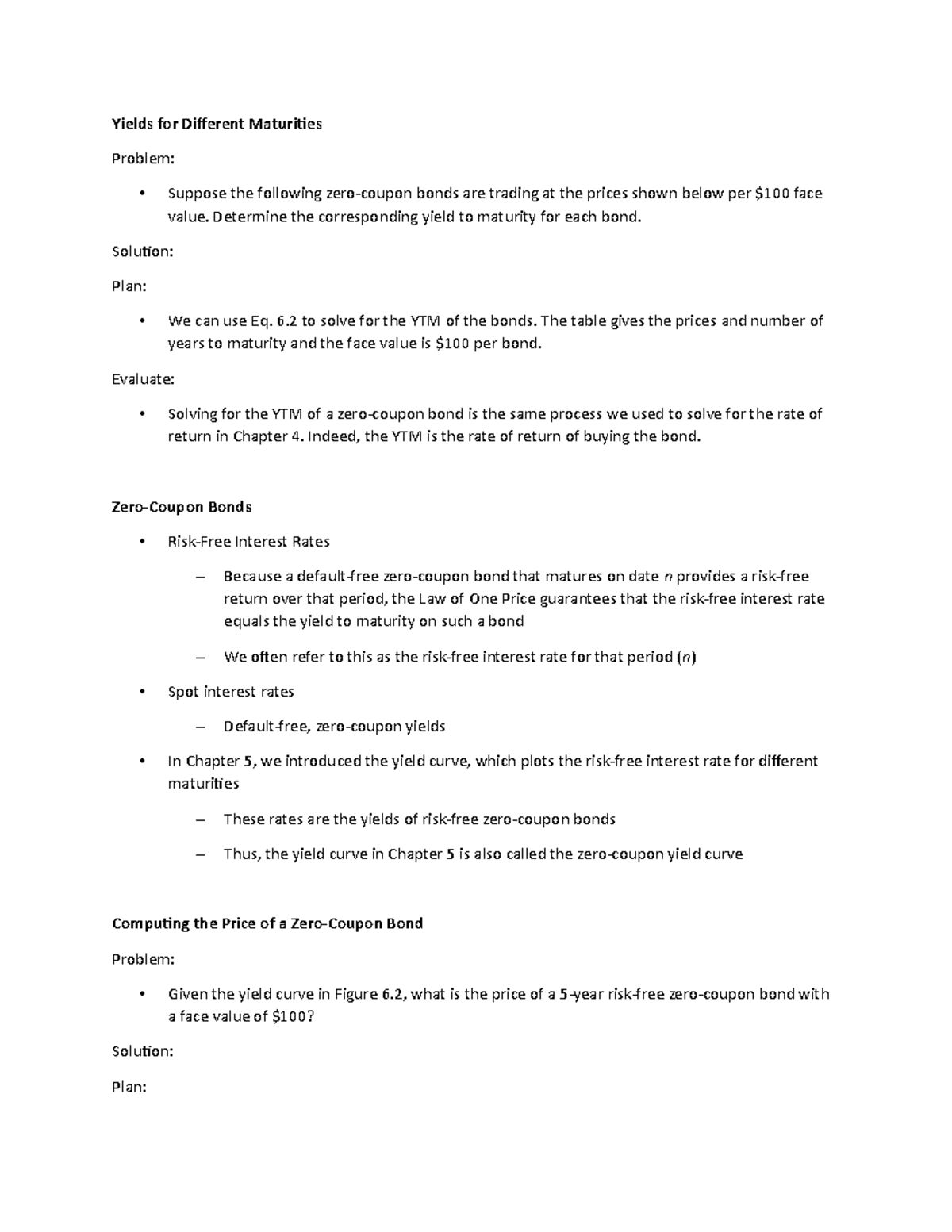

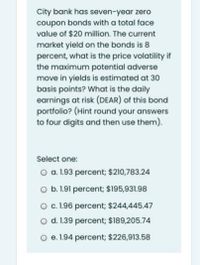

Risk of zero coupon bonds. Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. What Is a Zero-Coupon Bond? - Investopedia Zero-coupon bonds are like other bonds, in that they do carry various types of risk, because they are subject to interest rate risk if investors sell them before maturity. How Does a... Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US ...

Zero Coupon Muni Bonds - What You Need to Know - MunicipalBonds.com The largest benefit of zero coupon muni bonds is the low minimum investment since the securities are sold at a discount to face value. For example, a bond with a face value of $10,000 that matures in 20 years with a 5.5% coupon may be purchased for less than $5,000. This means that investors can purchase more face value at a lower upfront ... Zero-coupon bonds news and analysis articles - Risk.net Zero-coupon bonds Original research The impact of compounding on bond pricing with alternative reference rates This paper looks at the impact of compounding on zero-coupon bond prices by considering the short rate when it follows a Gaussian diffusion process or a stochastic volatility jump-diffusion process. 12 Oct 2021 Banking What Is a Zero-Coupon Bond? Definition, Advantages, Risks That's true of bonds in general, but zeros are especially sensitive: Since they do not make interest payments, the size of the payoff that you get from the bond depends entirely on its present... Reinvestment Risk Definition - Investopedia Zero-coupon bonds (Z-bonds) are the only type of fixed-income security to have no inherent investment risk since they issue no coupon payments throughout their lives. Key Takeaways...

What Are Zero Coupon Bonds And Their Risks- Tavaga | Tavagapedia Risks associated with Zero-Coupon Bonds As there is no coupon rate, ZCBs are safer as compared to other fixed-income instruments, which are sensitive to changes in interest rates. But ZCBs do possess risk subjected to changes in interest rates if sold before maturity. Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero-Coupon Bonds: Pros and Cons - Management Study Guide No Reinvestment Risk: Zero-coupon bonds do not have any reinvestment risk. This is because the bond does not pay interest periodically. Hence, investors do not receive any cash flow which they have to reinvest periodically. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Unique Risks of Zero-Coupon U.S. Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk.

Managing Risk With Fixed Income: How to Buy Zero Coupon Bonds As this bond gets closer to its maturity date, the price will slowly drop down closer to 100. Final coupon will be paid along with the $1,000 worth of principal. The bottom option that I circled shows a coupon at 2.87 and a yield of 2.78, but notice that the price is nearly at Par or 100. There are arguments for and against buying bonds over par.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww But the Zero Coupon bonds remove the reinvestment risk. Zero Coupon bonds do not allow any periodic coupon payments and thus a fixed interest on Zero Coupon bonds is assured. Fixed returns: The Zero Coupon bond is an ideal choice for those who prefer the long-term investment and earn in a lump sum. The reason behind this is the assurance of a ...

Zero-Coupon Bonds and Taxes - Investopedia The zero-coupon bond has no such cushion, faces higher risk, and makes more money if the issuer survives. Zero-Coupon Bonds and Taxes Zero-coupon bonds may also appeal to investors...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "45 risk of zero coupon bonds"