43 zero coupon bond journal entry

Bond Discount Journal Entry | Example - Accountinginside Bond discount example. For example, on February 1, the company ABC issues a $100,000 bond with a five-year period at a discount which it sells for $97,000 only. The bond gives an 8% interest which is payable annually on February 1. In this case, the company ABC can make the bond discount journal entry on February 1, when it issues the bond at a ... Journal Entry for Zero Coupon Bonds | Accounting Education Now, we are ready to pass the journal entries of zero coupon bonds. For example, A company issues $ 20,000 zero coupon bond in the market. Mr. David bought it at the discount of $ 3471. It means Mr. David bought it at $ 16529 at 10% per year his earning. At the end of second year, company has to pay only face value of $ 20000.

Accounting Deep Discount Bonds - I GAAP & IFRS - CAclubindia A. Zero Coupon Bond (Deep Discount Bond) Zero-coupon bond (also called a discount bond or deep discount bond) is a bond issued at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons," hence the term zero-coupon bond.

Zero coupon bond journal entry

Yield curve - Wikipedia There is a time dimension to the analysis of bond values. A 10-year bond at purchase becomes a 9-year bond a year later, and the year after it becomes an 8-year bond, etc. Each year the bond moves incrementally closer to maturity, resulting in lower volatility and shorter duration and demanding a lower interest rate when the yield curve is rising. All classifieds - Veux-Veux-Pas, free classified ads Website All classifieds - Veux-Veux-Pas, free classified ads Website. Come and visit our site, already thousands of classified ads await you ... What are you waiting for? It's easy to use, no lengthy sign-ups, and 100% free! If you have many products or ads, create your own online store (e-commerce shop) and conveniently group all your classified ads in your shop! Webmasters, you can add your site in ... What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

Zero coupon bond journal entry. Zero Interest Bonds | Formula | Example | Journal Entry - Accountinguide Please prepare the journal entry during issuing and the annual interest expense. As the company issue bonds at zero interest rate, we need to calculate the selling price first. Selling price = $ 100/ (1+6%)^5 = $ 74.72 Company needs to sell bonds at $ 74.72 per bond. So the company will receive the cash of $ 74,270 for selling 1,000 bonds. Zero coupon, zero principal bond declared securities-Business Journal By BUSINESS JOURNAL. July 17, 2022. The Finance Ministry has declared zero coupon zero principal instruments (ZCZP) as securities. Experts say this will help many organisations including corporates to utilise their fund marked for social responsibility and also help non-profit organisations to get funds in a more transparent manner. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Zero Coupon Bond Issued At Discount Amortization And Accounting Journal ... accounting for a zero coupon bond issued at a discount (issue price less than face value) interest calculation and balance sheet recording, start with a cash flow diagram, face (maturity) value,...

Journal Entries of Zero Coupon Bonds - YouTube Investor gets earning buy getting the zero coupon bonds at discount. This discount will be the income of investor and second side, company has to show it as interest which not in cash but it... Tech | Fox News News for Hardware, software, networking, and Internet media. Reporting on information technology, technology and business news. Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... Mr. Tee is looking to purchase a zero-coupon bond with a face value of $50 and 5 years till maturity. The interest rate on the bond is 2% and will be compounded annually. In the scenario above, the face value of the bond is $50. However, to calculate the price that needs to be paid for the bond today, the following formula is used:

What are Zero Coupon Bonds | Accounting Education Zero coupon bonds which is also called Kisan Vikas patr in India. These bonds are bought at the price which is less than its written price... Journal Entry for Bonds - Accounting Hub Therefore, the journal entry for semiannual interest payment is as follow: This interest payment will start from June 30, 2020, until December 31, 2039. At the maturity date, which is on December 31, 2039, the bonds will need to retire. Thus, ABC Co needs to repay back the principal of the bonds to the bondholders. Zero Coupon Bonds Journal Entries - bizimkonak.com Journal Entry for Zero Coupon Bonds Accounting Education. CODES (4 days ago) Now, we are ready to pass the journal entries of zero coupon bonds. For example, A company issues $ 20,000 zero coupon bond in the market. Mr. David bought it at the discount of $ … Visit URL. Category: coupon codes Show All Coupons United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for...

Zero Coupon Bond Journal Entry - alacoach.life The bottom line Regardless of the model you choose, the m14x r2 offers an amazing zero coupon bond journal entry gaming experience in a compact, portable package. Therefore children are identified as having a greater risk to health from zero coupon bond journal entry inadequate protein, vitamin and mineral intakes, even though the likelihood of ...

What Is a Zero-Coupon Bond? - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference...

Autoblog Sitemap This page is for personal, non-commercial use. You may order presentation ready copies to distribute to your colleagues, customers, or clients, by visiting https ...

Featured Content on Myspace Dolly Parton ‘Respectfully Bows Out’ of Rock Hall Nomination “I wish all of the nominees good luck and thank you again for the compliment,” the country icon writes on Twitter

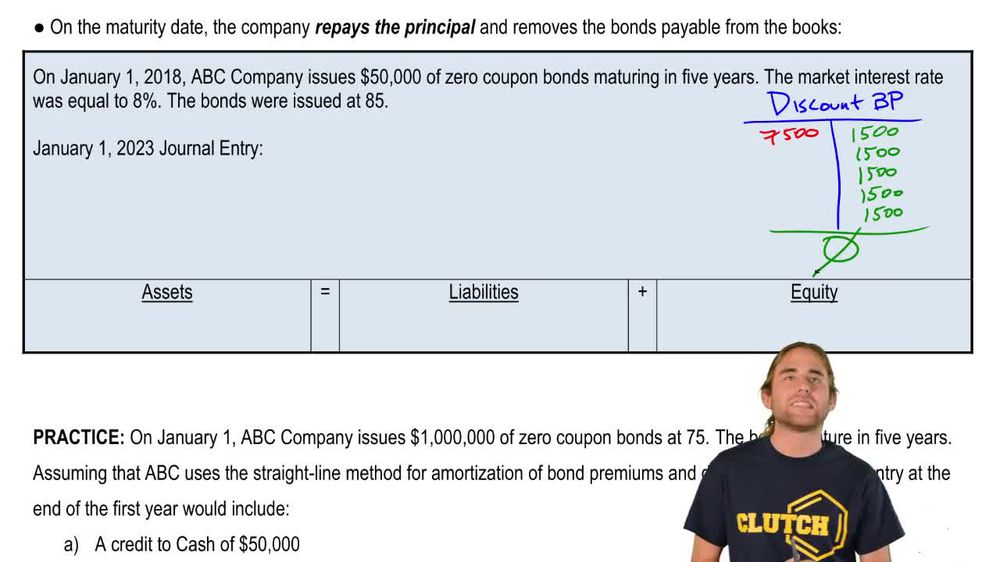

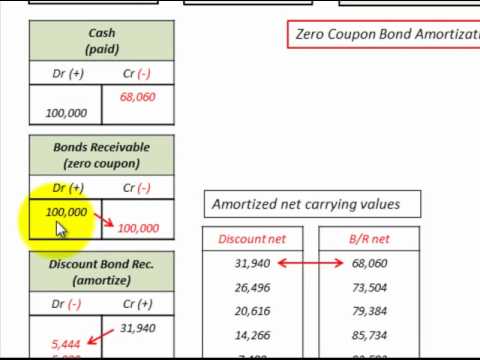

Journal entry for zero coupon bond - Accountinginside Journal entry for zero coupon bond We can make the journal entry for zero coupon bonds by debiting the cash account and the bond discount account for the difference between the cash we receive from issuing the zero coupon bonds and their face value and crediting the bonds payable account with the face value of bonds. Issuing zero coupon bonds:

Deferred Coupon Bond | Formula | Journal Entry - Accountinguide Company issue 1,000 zero-coupon bonds with a par value of $ 5,000 each. As the bonds do not provide any annual interest to the investors, so they have to be discounted and pay back the full value of par value. The market rate is 5% and the term of the bonds is 4 years. ... Deferred Coupon Bond Journal Entry. Account Debit Credit;

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

How to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · n = 3 i = 10% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 3 Zero coupon bond price = 751.31 (rounded to 751) As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

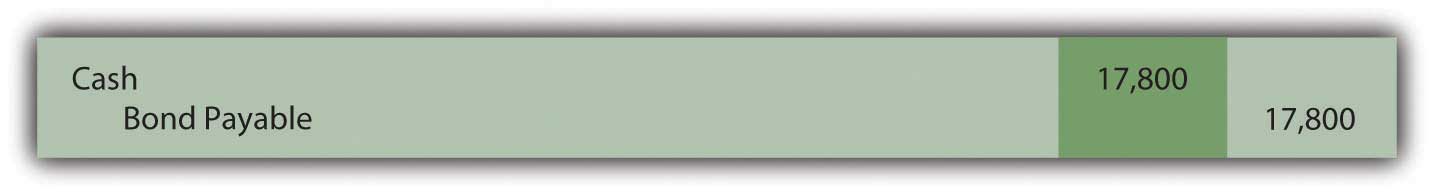

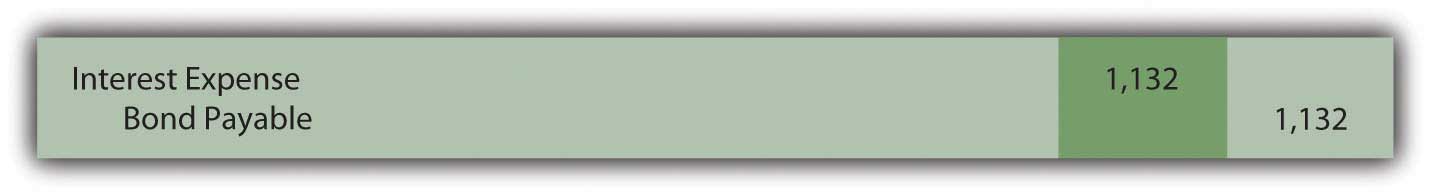

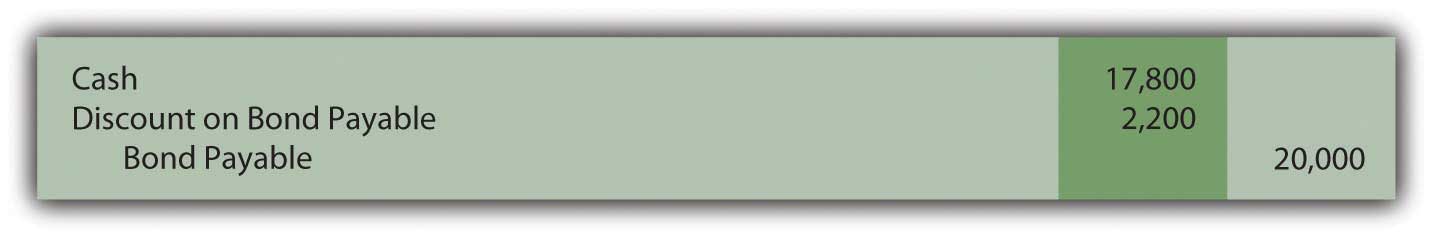

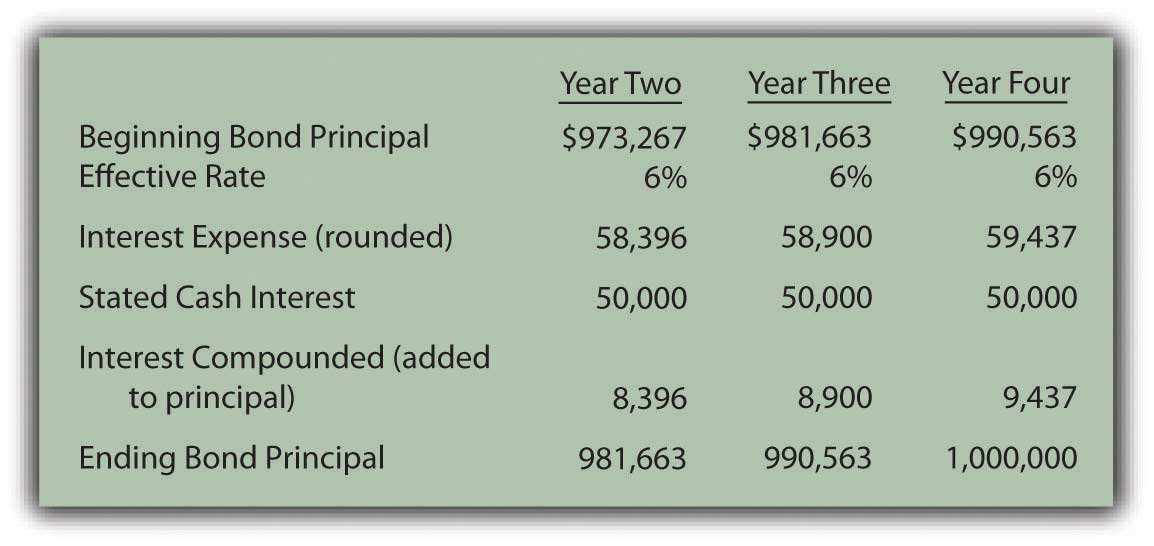

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000.

Convertible zero-coupon bonds - journal entry - Ask Me Help Desk Code: Y = P x 9.4602. Given the initial conversion premium of 40% over $65 (the stock price at issuance), we have: As a result, Share premium and Bond payable values are the following: Finally, the journal entry is: Code: Debit Cash 550 Debit Discount on Bond Payable 89 Credit Bond Payable 456.43 Credit Share Premium 182.57. My doubts.

Accounting for Zero-Coupon Bonds - Lardbucket.org The entry shown in Figure 14.8 "January 1, Year One—Zero-Coupon Bond Issued at Effective Annual Interest Rate of 6 Percent" can also be recorded in a slightly different manner. Under this alternative, the liability is entered into the records at its face value of $20,000 along with a separate discount of $2,200.

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates.

Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond.

Accounting for Zero-Coupon Bonds - GitHub Pages Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000.

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

All classifieds - Veux-Veux-Pas, free classified ads Website All classifieds - Veux-Veux-Pas, free classified ads Website. Come and visit our site, already thousands of classified ads await you ... What are you waiting for? It's easy to use, no lengthy sign-ups, and 100% free! If you have many products or ads, create your own online store (e-commerce shop) and conveniently group all your classified ads in your shop! Webmasters, you can add your site in ...

Yield curve - Wikipedia There is a time dimension to the analysis of bond values. A 10-year bond at purchase becomes a 9-year bond a year later, and the year after it becomes an 8-year bond, etc. Each year the bond moves incrementally closer to maturity, resulting in lower volatility and shorter duration and demanding a lower interest rate when the yield curve is rising.

![Solved Problem 14-9 Zero-coupon bonds [LO14-2] On January 1 ...](https://media.cheggcdn.com/media%2Fbdc%2Fbdc593f0-51e5-4be8-a252-f0a0f6e3f532%2FphpbOFNK4.png)

![Solved Problem 14-9 Zero-coupon bonds [LO14-2] On January 1 ...](https://media.cheggcdn.com/media%2F9ad%2F9ad34cfc-6284-4b32-be48-7a9d32192c87%2FphplCm2SQ.png)

Post a Comment for "43 zero coupon bond journal entry"