43 a general co bond has an 8% coupon

Coupon Bond - Investopedia Real-World Example of a Coupon Bond If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This means... quiz 3 - bond valuation - SU (selviautama) 29 Oct 2011 — A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50.

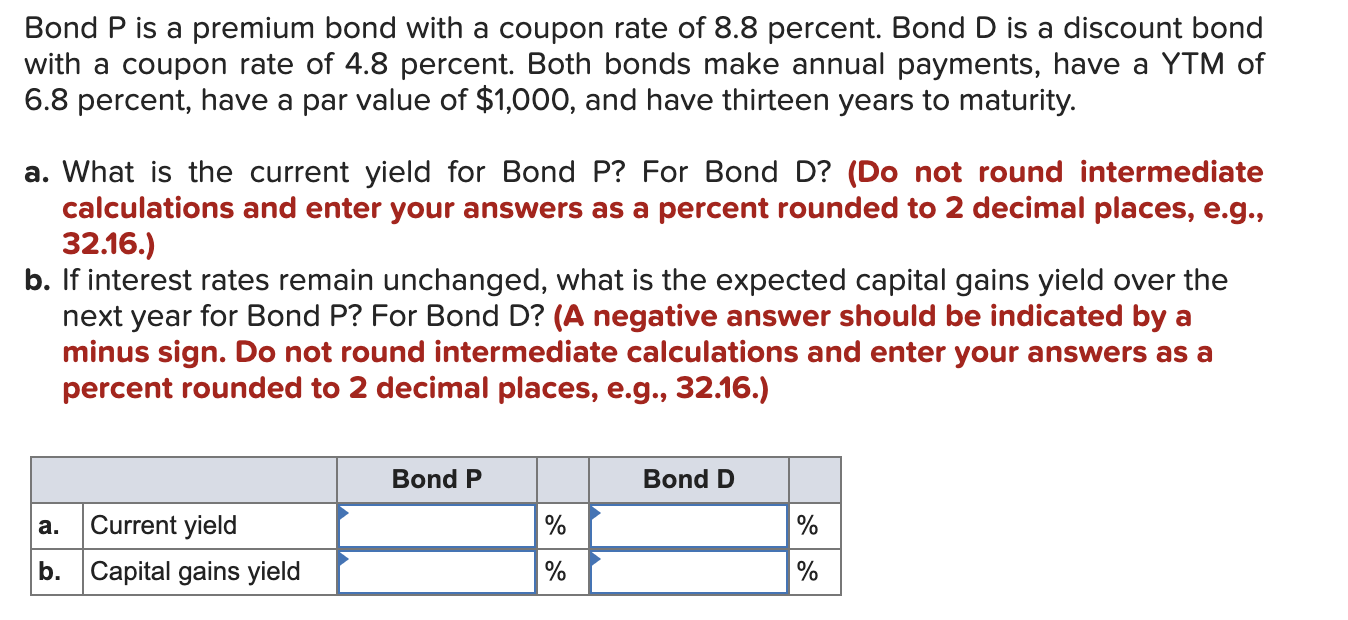

FIN Ch. 6 Flashcards | Quizlet a. holder If a firm could sell a mortgage bond at an 8% interest rate, it could sell an otherwise identical debenture at a. a rate less than 8% b. 8% c. a rate greater than 8% d. cannot be determined c. a rate greater than 8% When the market for an asset is in equilibrium, the expected rate of return on the asset is equal to the: a. risk-free rate

A general co bond has an 8% coupon

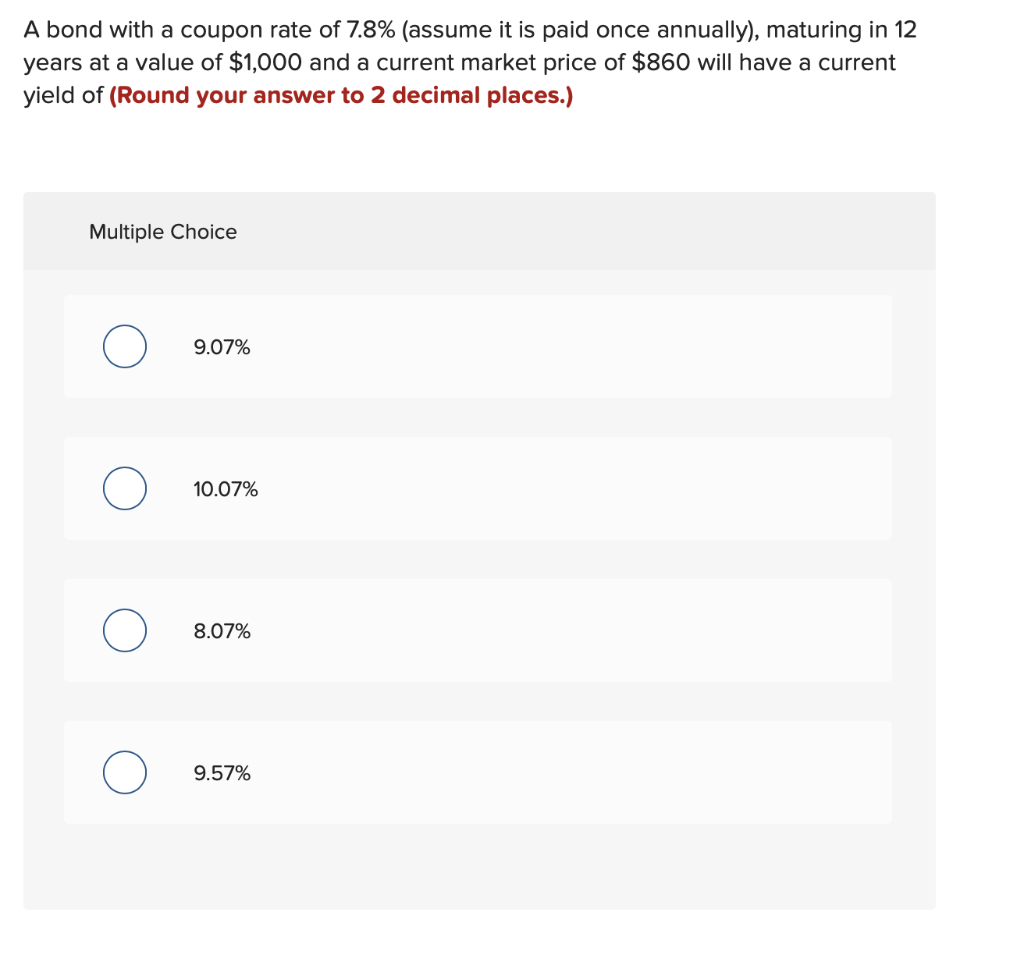

Coupon Definition - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. A General Co bond has an 8 coupon and pays interest ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in20 years. What is the yield to maturity? A. 7.79 % B. 7.82% C. 8.00% D. 8.04% E. 8.12% B. 7.82 % Yield to maturity is the annual rate of return an investor receives if a bond is held to maturity. Answered: A General Power bond carries a coupon… | bartleby A General Power bond carries a coupon rate of 8.5%, has 9 years until maturity, and sells at a yield to maturity of 7.5%. (Assume annual interest payments.) a. What interest payments do bondholders receive each year? b. At what price does the bond sell? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c.

A general co bond has an 8% coupon. Finance 320 Quiz 3 Flashcards | Quizlet Massey Co. has 12 percent coupon bonds making annual payments with YTM of 9 percent. The current yield on these bonds is 9.80 percent. ... Since then, interest rates in general have risen, and the yield to maturity on the Thompson Tarps bonds is now 12%. Given this information, what is the price today for a Thompson Tarps bond? Finance Chapter 5 Flashcards - Quizlet If you invest in a $1,000 corporate bond that has a 9 percent coupon and makes semi-annual payments, you can expect to receive ___ each six months. $ 45 every 6 months. A corporation issues 50,000 bonds at $1,000 each. The bonds mature in 5 years and have a coupon rate of 7 percent. Finance Ch. 5-7 Quiz Questions Flashcards - Quizlet A General Co. bond has a coupon rate of 7 percent and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. Solved A General Co. bond has an 8% coupon and pays | Chegg.com A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 7 years. What is the yield to maturity? A. 7.62% B. 7.79% C. 8.24% D. 8.12% Question: A General Co. bond has an 8% coupon and pays interest semiannually.

The bonds of the Nordy Company have a coupon interest rate of 9%.... Value = Par value * (1 + Coupon rate * Number of years to maturity) / (1 + Required rate of return) For this problem, we have: Value = $1,000 * (1 + 0.09 * 8) / (1 + 0.08) Value = $1,045.45 The value of each bond is $1,045.45. Solved A General Co. bond has an 8% coupon and pays interest ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? Expert Answer 100% (10 ratings) Yield to Maturity is the internal rate of return of the Bond. It represents the amount of profit or loss on the … Vanilla Ice Co bonds pay an annual coupon rate of 10 and have 12 years ... The coupon rate is 8% payable annually, and interest rates on new issues with the same degree of risk are 10%. Youwant to know how many more interest payments you will receive, but the party selling the bond cannot remember. If the par value is $1,000, how many interest payments remain? PV= 863.73 CPN PMT= 1000 X 8% = 80 FV= 1000 I/Y= 10% PMTS= 12 Buying a $1,000 Bond With a Coupon of 10% - Investopedia These bonds typically pay out a semi-annual coupon. Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates ...

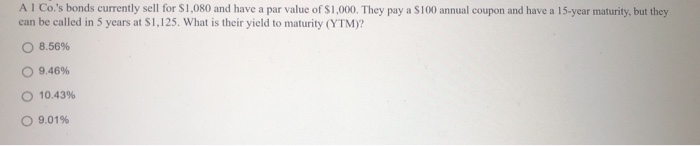

Solved 1a) A General Co. bond has an 8 percent coupon and ... 1a) A General Co. bond has an 8 percent coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? 1b) You intend to purchase a 10-year, $1,000 face value bond that pays interest of $60 every 6 months (semiannual). A four-year bond has an 8% coupon rate and a face value of $1000. If ... A four-year bond has an 8% coupon rate and a face value of $1000. If the current price of the bond is $878.51, calculate the yield to maturity of the bond (assuming annual interest payments). rick1765 is waiting for your help. Add your answer and earn points. You might be interested in amaanjaved1801 asked 08/05/2020 Yield to Maturity Questions and Answers | Study.com Dilli Co. has 10% coupon bonds making annual payments with a yield to maturity of 8.2%. ... The bonds have an 8% annual coupon rate and were issued 1 year ago at their par value of $1,200 ... CF Chp 8 Flashcards - Quizlet American Fortunes is preparing a bond offering with an 8% coupon rate. The bonds will be repaid in 10 years. The company plans to issue the bonds at par value and pay interest semiannually. Given this, which of the following statements are correct? I. The initial selling price of each bond will be $1,000. II.

A General Co. bond has an 8% coupon and pays interest annually. The ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? |...

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

A 12 year 5 coupon bond pays interest annually The bond has a face ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? A) 7.79% The bond sells at a premium, so its YTM has to be below 8%.

A General Co. bond has an 8 % coupon and pays interest annually. A General Co. bond has an 8 % coupon and pays interest annually. The face value is $1,000 and the current market price.

FIN 3000 HW 6 Flashcards - Quizlet A General Power bond with $1000 par value carries a coupon rate of 8%, has 9 years until maturity, and sells at a yield to maturity of 7%. ... Sure Tea Co. has issued 9% annual coupon bonds of which face value is $1000 that are now selling at a yield to maturity of 10% and current yield of 9.8375%. What is the remaining maturity of these bonds?

Answered: Bond prices. Price the bonds from the… | bartleby Q: An annual coupon bond has a coupon rate of 8%, face value of $100, and 3 years to maturity. If its… A: Period Cash Flow ($) PVF @3.2% PV of cash flow ($) PV of time weighted cash flow ($) 1 8 0.9690…

A General Co. bond has an 8% coupon and pays interest semiannually. The ... Answer to: A General Co. bond has an 8% coupon and pays interest semiannually. The face value is $1,000 and the current market price is $1,020.50. The bond...

International bonds: Assicurazioni Generali, 5.8% 6jul2032, EUR ... Issue Information International bonds Assicurazioni Generali, 5.8% 6jul2032, EUR. Issue, Issuer, Yield, Prices, Payments, Analytical Comments, Ratings

How to Calculate the Price of Coupon Bond? - WallStreetMojo Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd.

Solved A General Co. bond has an 8% coupon and pays interest ... A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is the yield to maturity? 7.82% 8.12% 8.04% 7.79% 8.00%.

8 a general co bond has an 8 coupon and pays interest A General Co. bond has an 8% coupon and pays interest annually. The face value is $1,000 and the current market price is $1,020.50. The bond matures in 20 years. What is theyield to maturity? a. 7.79%b. 7.82% c. 8.00%d. 8.04% e. 8.12% ( a) 9. Wine and Roses, Inc. offers a 7% coupon bond with semiannual payments and a yield tomaturity of 7.73%.

Post a Comment for "43 a general co bond has an 8% coupon"