43 coupon rate bond formula

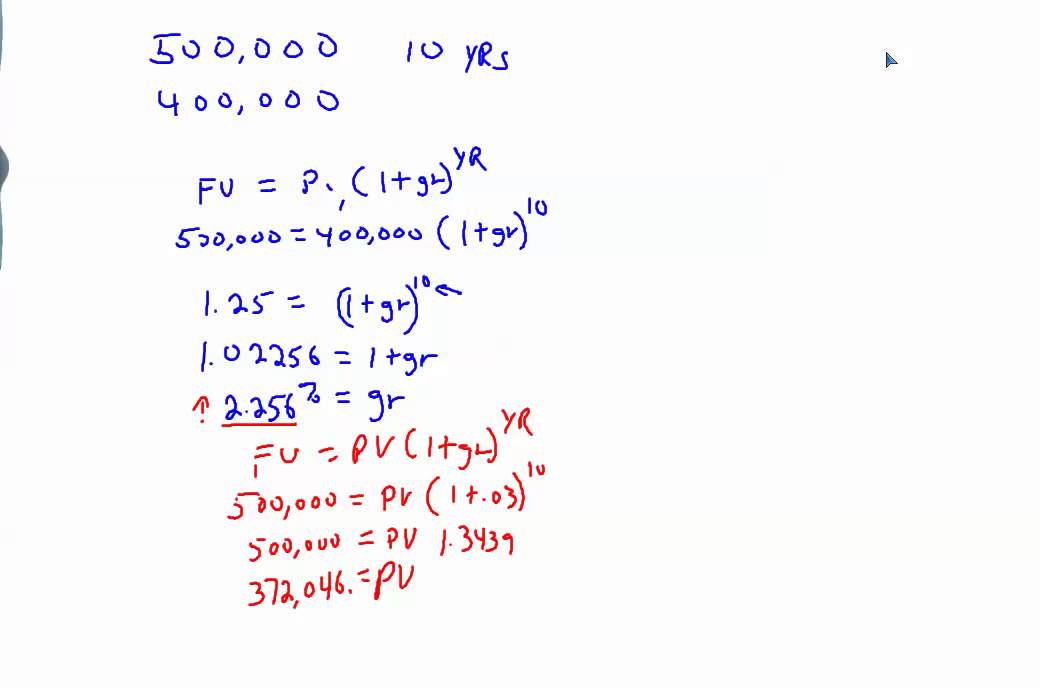

nerdcounter.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years’ maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. Bond: Financial Meaning With Examples and How They Are Priced 01/07/2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

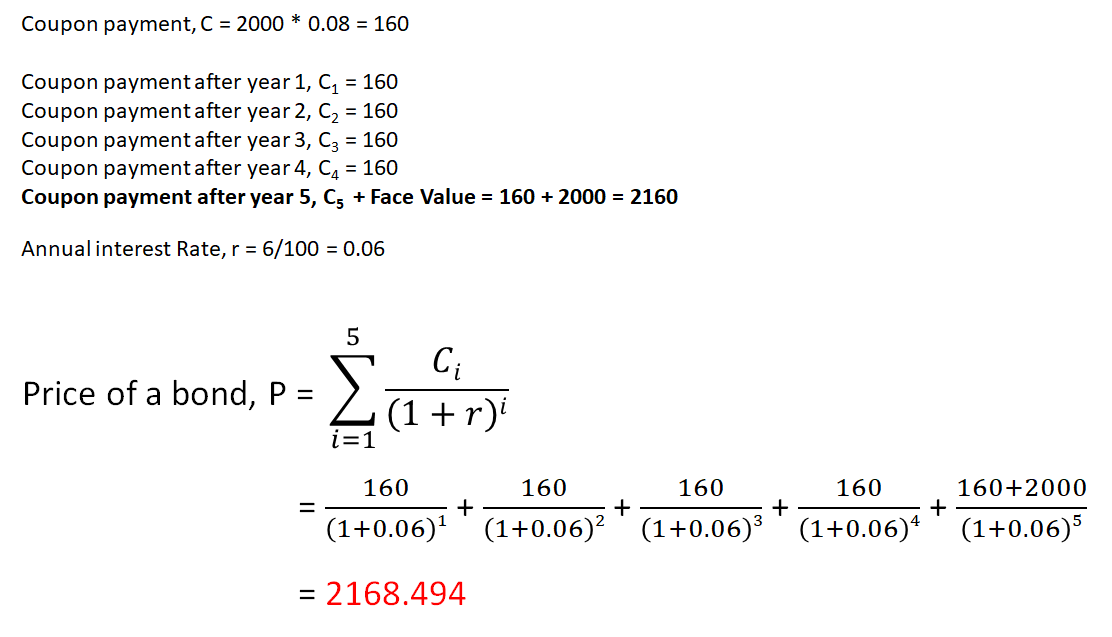

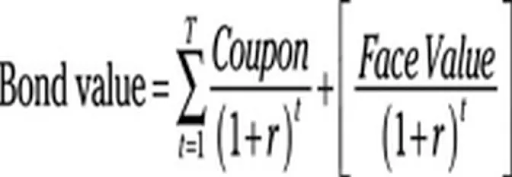

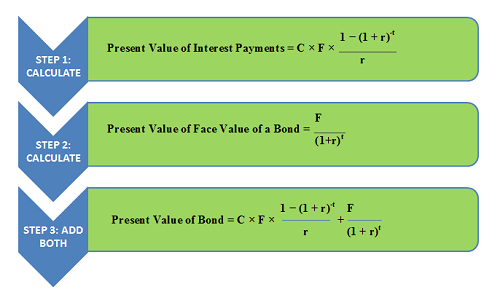

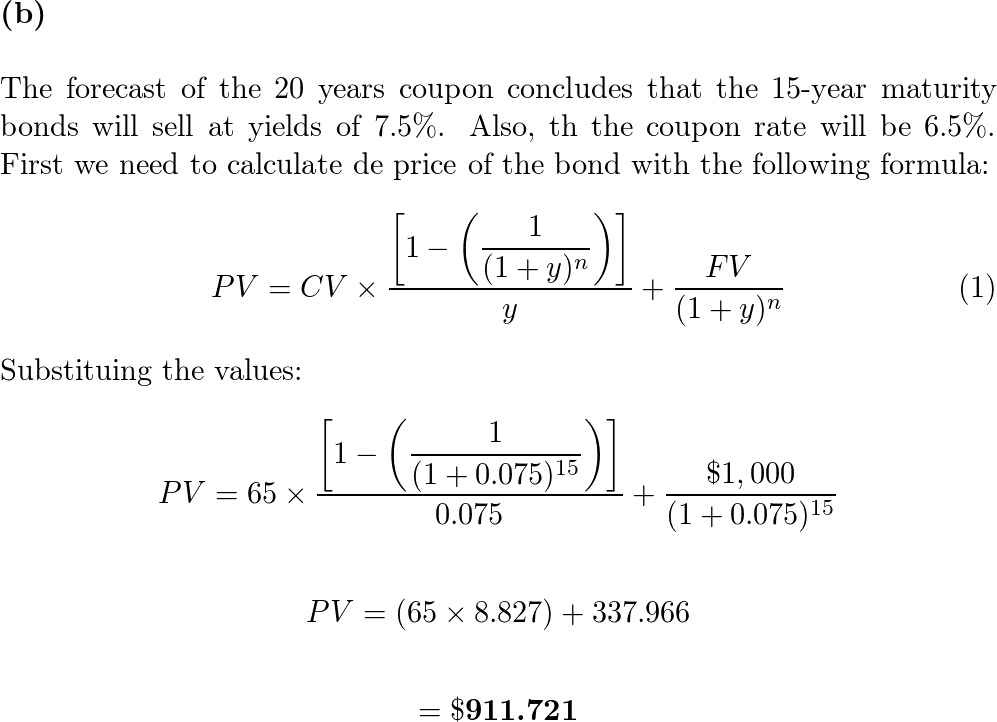

Bond Yield Formula | Calculator (Example with Excel Template) Step 4: Finally, the formula for the bond price can be used to determine the YTM of the bond by using the expected cash flows (step 1), number of years until maturity (step 2) and bond price (step 3) as shown below. Bond Price = ∑ [Cash flow t / (1+YTM) t]. The formula for a bond’s current yield can be derived by using the following steps: Step 1: Firstly, determine the …

Coupon rate bond formula

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples. Let us take the example of a bond with quarterly coupon payments. Let us assume a company XYZ Ltd has issued a bond having a face value of $1,000 and quarterly interest … Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula helps in calculating and comparing the coupon rate of differently fixed income securities and helps to choose the best as per the requirement of an investor. It also helps in assessing the cycle of interest rate and expected market value of a bond, for eg. If market interest rates are declining, the market value of bonds with higher interest rates will increase, … What Is a Bond Coupon, and How Is It Calculated? - Investopedia 02/04/2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

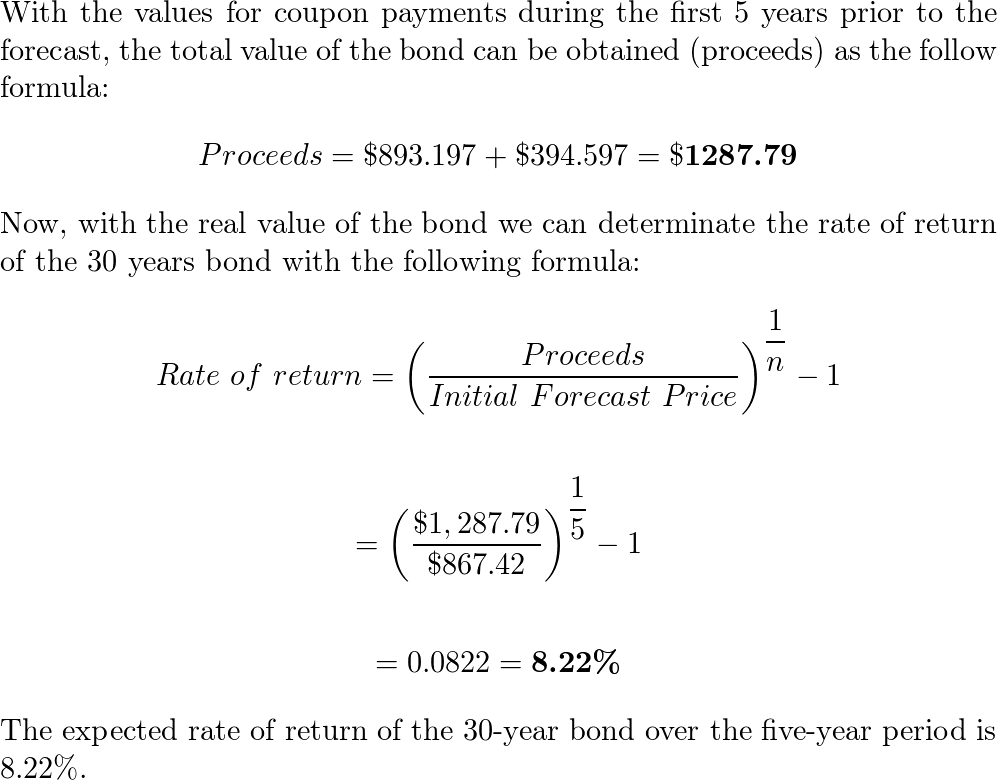

Coupon rate bond formula. › terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Rate of Return Formula | Calculator (Excel template) - EDUCBA In this formula, any gain made is included in formula. Let us see an example to understand it. Rate of Return Formula – Example #3. An investor purchase 100 shares at a price of $15 per share and he received a dividend of $2 per share every year and after 5 years sell them at a … › coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) The coupon Rate Formula is used to calculate the coupon rate of the bond, and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments by the par value of the bonds and multiplying the resultant with the 100. › effective-tax-rate-formulaEffective Tax Rate Formula | Calculator (Excel Template) - EDUCBA For 2018. Effective Tax Rate = 10.6% For 2017. Effective Tax Rate = 20.2% Explanation. Because of the progressive tax system, all the income will not be taxed at the same rate.

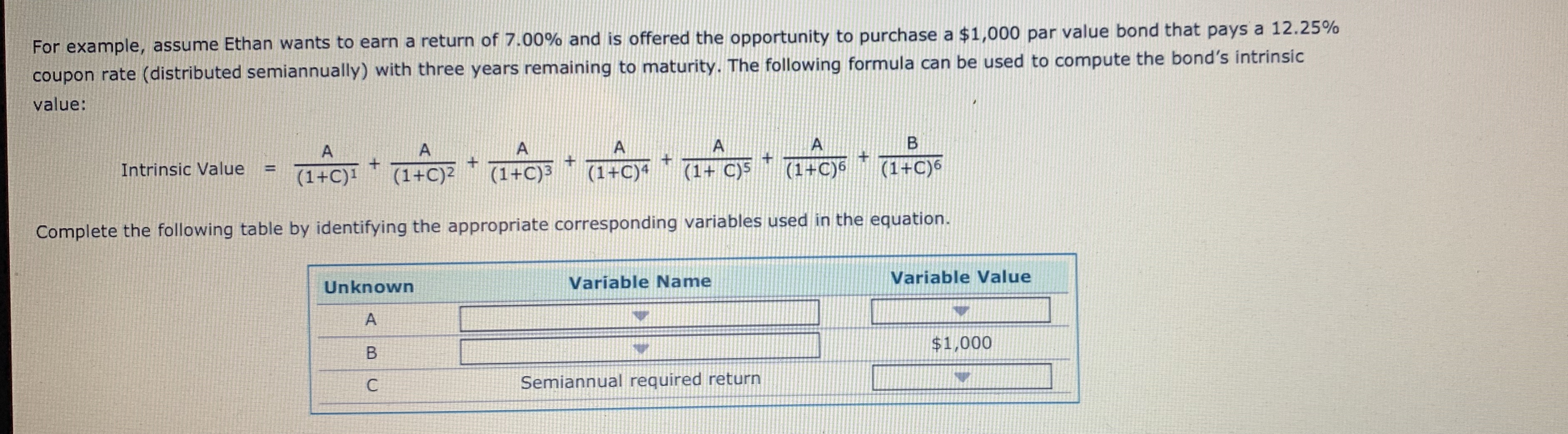

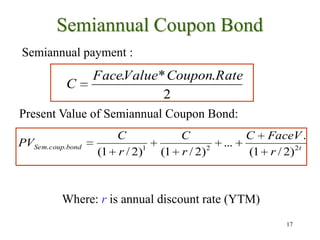

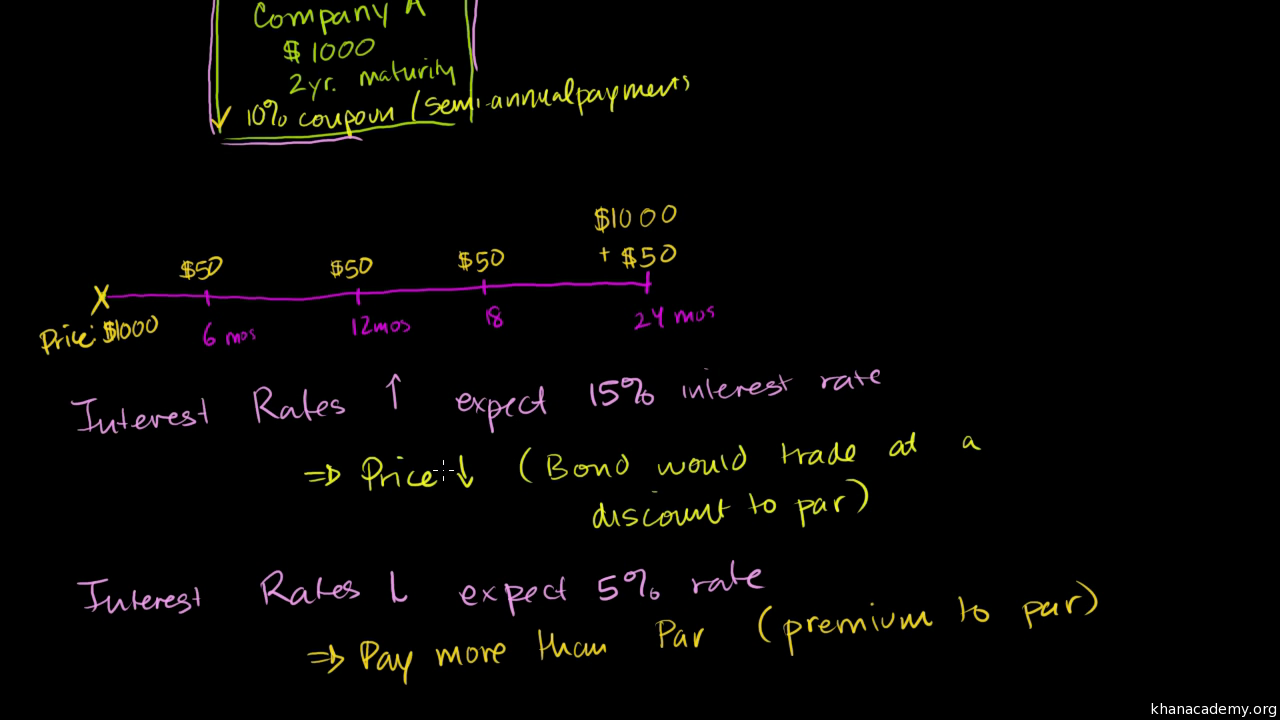

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate Required Rate of Return Formula | Calculator (Excel template) Required Rate of Return = (2.7 / 20000) + 0.064; Required Rate of Return = 6.4 % Explanation of Required Rate of Return Formula. CAPM: Here is the step by step approach for calculating Required Return. Step 1: Theoretically RFR is risk free return is the interest rate what an investor expects with zero Risk. Practically any investments you take, it at least carries a low risk so it is … › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples Let us take the example of a bond with quarterly coupon payments. › bond-pricing-formulaBond Pricing Formula |How to Calculate Bond Price? - EDUCBA Bond pricing formula depends on factors such as a coupon, yield to maturity, par value and tenor. These factors are used to calculate the price of the bond in the primary market. In the secondary market, other factors come into play such as creditworthiness of issuing firm, liquidity and time for next coupon payments.

› knowledge › bond-yieldBond Yield: Formula and Percent Return Calculation Step 2: The annual coupon is a function of the bond’s coupon rate, par value, and payment frequency – and, if applicable, the coupon rate must be annualized. Step 3 : The current yield formula equals the annual coupon payment divided by the bond’s current market price, expressed as a percentage. Coupon Bond Formula | Examples with Excel Template - EDUCBA In case a bond offers a lower coupon rate than the market, the bond investor intends to bring down the price of the bond so its return matches the market return. Inherently, investors are attracted to bonds with higher coupon rates. So, as more and more investors purchase these high yield bonds and push the prices up which eventually brings its return to the level of the … Coupons.com: Online Promo Codes and Free Printable Coupons Top discounts and coupon codes for the most popular retailers. Black Friday . Christmas Sales. Valentine's Day Sales. Presidents' Day Sales. March Madness Sales. Easter Sales. Best Coupons Save more with the biggest and best promo codes. Deal Chewy 25% OFF Dry Cat Food Up to 25% Off. Code Pizza Hut 15% OFF 15% Off Select Menu Items Expiration date: … What Is a Bond Coupon, and How Is It Calculated? - Investopedia 02/04/2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula helps in calculating and comparing the coupon rate of differently fixed income securities and helps to choose the best as per the requirement of an investor. It also helps in assessing the cycle of interest rate and expected market value of a bond, for eg. If market interest rates are declining, the market value of bonds with higher interest rates will increase, …

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples. Let us take the example of a bond with quarterly coupon payments. Let us assume a company XYZ Ltd has issued a bond having a face value of $1,000 and quarterly interest …

Post a Comment for "43 coupon rate bond formula"