42 treasury bonds coupon rate

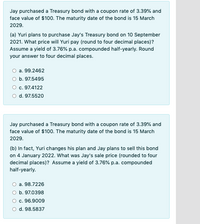

Treasury Seeks Public Input on Implementing the Inflation Reduction Act ... Treasury today issues six requests for comment on key provisions to lower energy costs, tackle climate change WASHINGTON, D.C. — The U.S. Department of the Treasury and the Internal Revenue Service (IRS) today issued six Notices requesting public input on key climate and clean energy tax incentives in the Inflation Reduction Act. The Notices mark a key first step in the formal process of ... 10-Year T-Note Futures Quotes - CME Group Among the most actively watched benchmarks in the world, the 10-Year U.S. Treasury Note futures contract offers unrivaled liquidity and capital-efficient, off-balance sheet Treasury exposure, making it an ideal tool for a variety of hedging and risk management applications, including: interest rate hedging, basis trading, adjusting portfolio duration, curve trading, expressing directional ...

US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 15 hours ago, on 6 Oct 2022 Frequency daily Description These yield curves...

Treasury bonds coupon rate

US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury. US10YT. Yield 3.62. Today's Change 0.006 / 0.17%. 1 Year change +136.64%. Data delayed at least 20 minutes, as of Oct 05 2022 03:44 BST. Summary. Treasury Coupon Rate Question : r/investing - reddit.com Bond yields are pretty volatile. Generally the treasury wants a price close to 100 and a yield in even .25% increments. The auction works out the details. So for example the last 3 year auction was Sept 8th for Sept 15th delivery. Yield was 3.5% and price was 99.819428 for a total return of 3.54%. Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

Treasury bonds coupon rate. Treasury Bills Statistics - Monetary Authority of Singapore SGS T-bill Yield Curve. 6 12 Tenor (Months) 2.870 2.875 2.880 2.885 2.890 Yield (%) Latest Yield. Previous Week. US2Y: U.S. 2 Year Treasury - Stock Price, Quote and News - CNBC KEY STATS Yield Open 4.148% Yield Day High 4.171% Yield Day Low 4.131% Yield Prev Close 4.15% Price 100.1484 Price Change -0.0391 Price Change % -0.0391% Price Prev Close 100.1875 Price Day High... Treasury Bill Rates - NASDAQ - Datastore The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill`s yield based on the purchase price, discount, and a 365- or 366-day year. Treasury Bonds Rates - WealthTrust Securities Limited Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium) or below Rs. 100 (discount). While offering higher return than other fixed income investments, T-Bond investments can be liquidated instantly by way of the secondary market.

Current Rates | Edward Jones 5.25%. $10,000,000 and over. 5.00%. Rates effective as of September 22, 2022 . The margin interest rate is variable and is established based on the higher of a base rate of 4.00% or the current prime rate. Our Personal Line of Credit is a margin loan and is available only on certain types of accounts. EGP T-Bonds Historical Monthly Average Interest Rates; EGP T-Bills Secondary Market; Time Series; Cairo Overnight Index Average - CONIA; Auctions. Treasury Auctions T-Bills. EGP T-Bills; USD T-Bills; EUR T-Bills; Treasury Auctions T-Bonds. EGP T-Bonds; EGP T-Bonds Zero Coupon; Deposits (OMO) Fixed Rate Deposits; Variable Rate Deposits; Corridor Linked Deposits; Repo ... iShares 1-3 Year Treasury Bond ETF | SHY - BlackRock iShares 1-3 Year Treasury Bond ETF ($) The Hypothetical Growth of $10,000 chart reflects a hypothetical $10,000 investment and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted. 91 Day T Bill Treasury Rate - Bankrate Year ago. 91-day T-bill auction avg disc rate. 3.34. 2.88. 0.04. What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a ...

BONDS | BOND MARKET | PRICES | RATES | Markets Insider The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the respective bond yields. ... The credit terms for bonds, such as the rate of return, term ... What Are Treasury Inflation-Protected Securities? How Do They Work? TreasuryDirect, the website of the U.S. Treasury, which offers Treasury securities for purchase, also links to CPI data and publishes the most up-to-date yield rates for TIPS on this webpage.... Government Bond: What It Is, Types, Pros and Cons - Investopedia Government Bond: A government bond is a debt security issued by a government to support government spending. Federal government bonds in the United States include savings bonds, Treasury bonds and ... Daily Treasury Yield Curve Rates - YCharts Daily Treasury Yield Curve Rates are commonly referred to as "Constant Maturity Treasury" rates, or CMTs. Yields are interpolated by the Treasury from the daily yield curve. This curve, which relates the yield on a security to its time to maturity is based on the closing market bid yields on actively traded Treasury securities in the over-the ...

Today's Prices - TreasuryDirect SLGS Rates; IRS Tax Credit Bonds Rates; Treasury's Certified Interest Rates; Average Interest Rates; UTF Quarterly Yields; ... RATE MATURITY DATE CALL DATE BUY SELL END OF DAY; 912796YD5: MARKET BASED BILL: 0.000%: 10/11/2022: 0.000000: 99.960972: 0.000000: 912796V55: MARKET BASED BILL: 0.000%: 10/13/2022:

Treasury Rates, Interest Rates, Yields - Barchart.com Treasury notes (or T-Notes) mature in one to ten years, have a coupon payment every six months, and have denominations of $1,000. In the basic transaction, one buys a "$1,000" T-Note for say, $950, collects interest over 10 years of say, 3% per year, which comes to $30 yearly, and at the end of the 10 years cashes it in for $1000.

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.775% yield. 10 Years vs 2 Years bond spread is -39.4 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.25% (last modification in September 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

What Are Treasury Securities and How Do They Work? What Are Treasury Securities in Simple Terms?Treasury securities, also known as Treasuries, are government bonds from the United States Treasury Department. Investors find them attractive because ...

Treasury Takes Additional Sanctions Actions Across Bosnia and ... WASHINGTON — Today, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) designated two individuals and one business entity in Bosnia and Herzegovina (BiH) pursuant to Executive Order (E.O.) 14033. These designations follow OFAC's September 26, 2022 designation of a corrupt state prosecutor in BiH and build on other recent sanctions imposed on individuals and ...

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 4.234% yield. 10 Years vs 2 Years bond spread is 9.8 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.25% (last modification in September 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

What Is a Treasury Note? How Does It Work? | Arena | news-daily.com T-bills: Treasury bills (T-bills) mature in 1 year or less and do not offer a yield. For this reason, they are also known as zero-coupon bonds. Unlike other Treasury securities, these bonds trade...

Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... Right now, however, the I Bond's fixed rate of 0.0% is a stunning 168 basis points below the real yield of a 10-year TIPS. That makes TIPS — a more complicated investment — more attractive. The Treasury should recognize this and raise the I Bond's fixed rate. I am going to suggest 0.3% to 0.5%.

US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury Bond, chart, prices - FT.com Bonds US 10 year Treasury US10YT Yield 3.77 Today's Change 0.010 / 0.27% 1 Year change +147.30% Data delayed at least 20 minutes, as of Oct 06 2022...

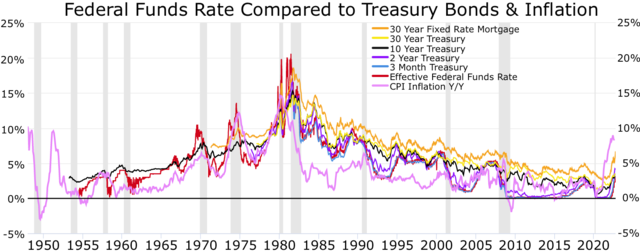

20 Year Treasury Rate - YCharts The 20 year treasury yield is included on the longer end of the yield curve. The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 4.08%, compared to 4.05% the previous market day and 2.02% last year.

U.S. Treasury Bond Futures Quotes - CME Group US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. ... Discover a streamlined approach to trading interest rate markets with Micro Treasury Yield futures, contracts based directly on ...

Treasury Bills | Constant Maturity Index Rate Yield Bonds Notes US 10 5 ... Bankrate.com displays the US treasury constant maturity rate index for 1 year, 5 year, and 10 year T bills, bonds and notes for consumers.

Treasury Coupon Rate Question : r/investing - reddit.com Bond yields are pretty volatile. Generally the treasury wants a price close to 100 and a yield in even .25% increments. The auction works out the details. So for example the last 3 year auction was Sept 8th for Sept 15th delivery. Yield was 3.5% and price was 99.819428 for a total return of 3.54%.

US 10 year Treasury Bond, chart, prices - FT.com US 10 year Treasury. US10YT. Yield 3.62. Today's Change 0.006 / 0.17%. 1 Year change +136.64%. Data delayed at least 20 minutes, as of Oct 05 2022 03:44 BST. Summary.

/GettyImages-182832748-af3f3d3824034fdaa66ac937fc2d7a40.jpg)

:max_bytes(150000):strip_icc()/UnderstandingTreasuryYieldAndInterestRates2-81d89039418c4d7cae30984087af4aff.png)

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

Post a Comment for "42 treasury bonds coupon rate"