40 relationship between coupon rate and ytm

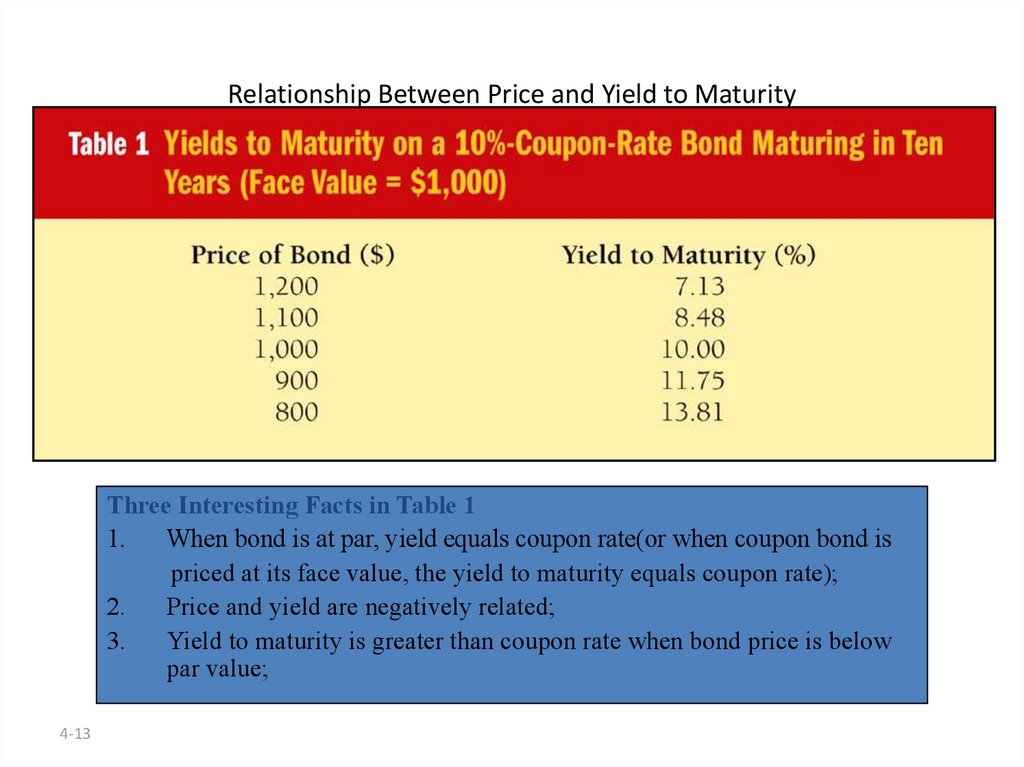

Relationship Between Coupon and Yield - Assignment Worker YTM with Semiannual Coupons. 40 N. 1197.93 PV (negative) 1000 FV. 50 PMT. CPT PV 4% (= ½ YTM) YTM = 4%*2 = 8%. NOTE: Solving a semi-annual payer for YTM. results in a 6-month yield. The calculator & Excel. solve what you enter. The 4% value is the 6-month interest rate. YTM is an annual rate. Important Differences Between Coupon and Yield to Maturity - The Balance Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

What relationship between a bond's coupon rate and a bond's yield would ... Investment Management Consulting Author has 4.5K answers and 4.6M answer views 5 y If yield is higher than the coupon rate then the bond is trading at a discount. Let's say you own a bond that you paid $1,000 for and it has a coupon rate of 10%. That means that this Bond will pay $100 per year in interest no matter what its price on the market.

Relationship between coupon rate and ytm

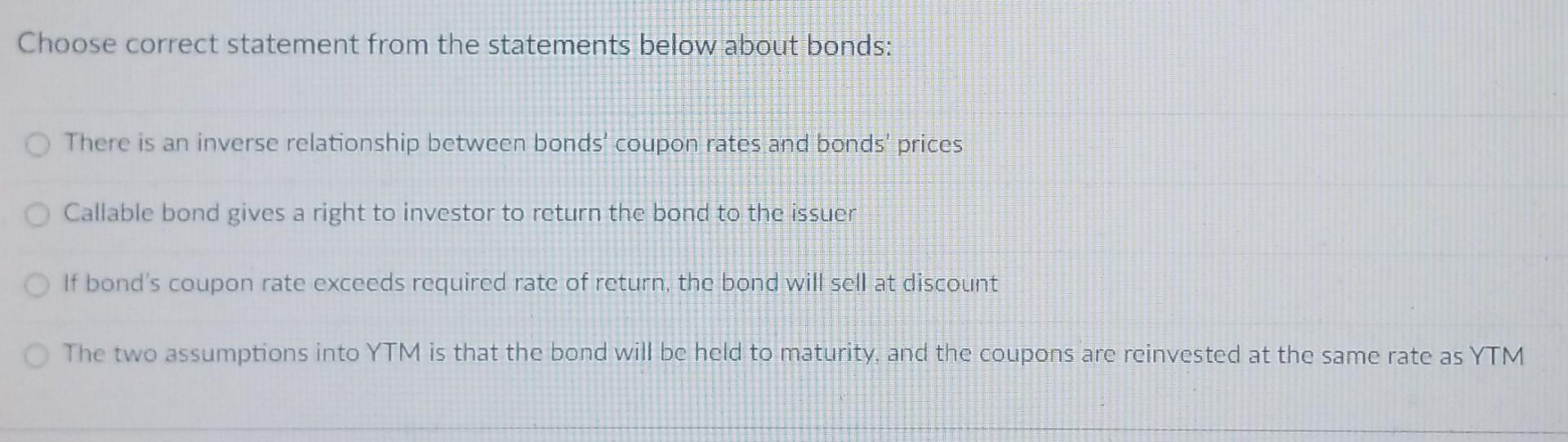

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion Relationship Between Coupon Interest Rate And Ytm Set in Bandung, which is approximately 2 hours drive from Jakarta and features a comfortably cooler climate than relationship between coupon interest rate and ytm most Indonesian cities, the Hilton Bandung hotel is only a short drive to the many dining and entertainment options at nearby Paris Van Java. Puerto de la Cruz was once a retreat for ... How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow May 06, 2021 · Yield to Maturity (YTM) for a bond is the total return, interest plus capital gain, obtained from a bond held to maturity. ... Estimate the interest rate by considering the relationship between the bond price and the yield. ... Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the ...

Relationship between coupon rate and ytm. Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ... Difference between YTM and Coupon Rates YTM is the acronym for "yield to maturity", and it measures the rate of return an investor would earn if they held a bond until it reached maturity. YTM accounts for both the interest payments made (the coupon rate) as well as any capital gains or losses. A coupon rate, on the other hand, is simply the interest rate that is paid out on a ... Relationship Between Coupon Rate And Ytm The great news is that I have plenty of products to relationship between coupon rate and ytm use in February and I also have lots of items I can way basics coupons this month. Ll Bean Credit Card Coupons. fasttech coupon feb 2014 For more details about car insurance excesses and quotes in general, visit our car insurance comparison guide. Enter ... The Relationship Between a Bond's Price & Yield to Maturity However, if you only pay $900 for the bond, your yield to maturity will be greater because, in addition to the 6 percent interest, you'll earn a capital gain of $100. If you paid more than $1,000 for the bond, your yield to maturity would be less than 6 percent, as you would get back less than you paid at maturity. 00:00 00:00.

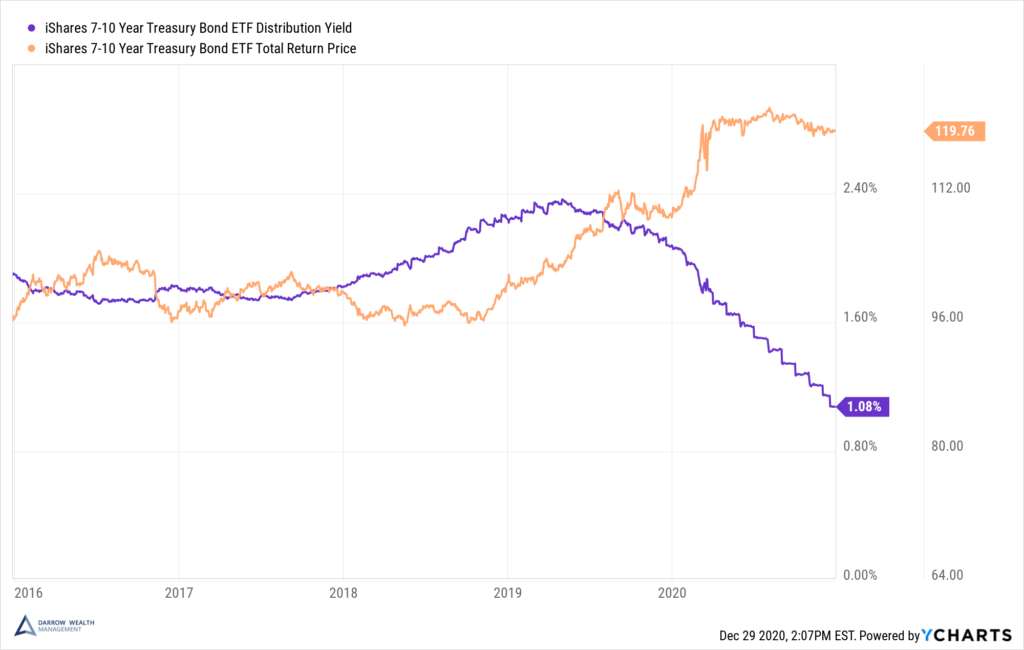

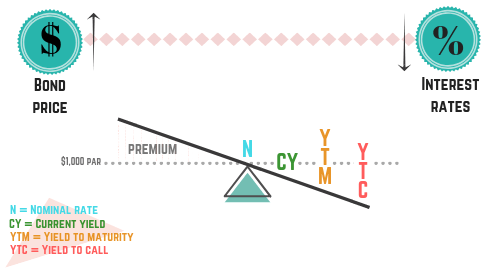

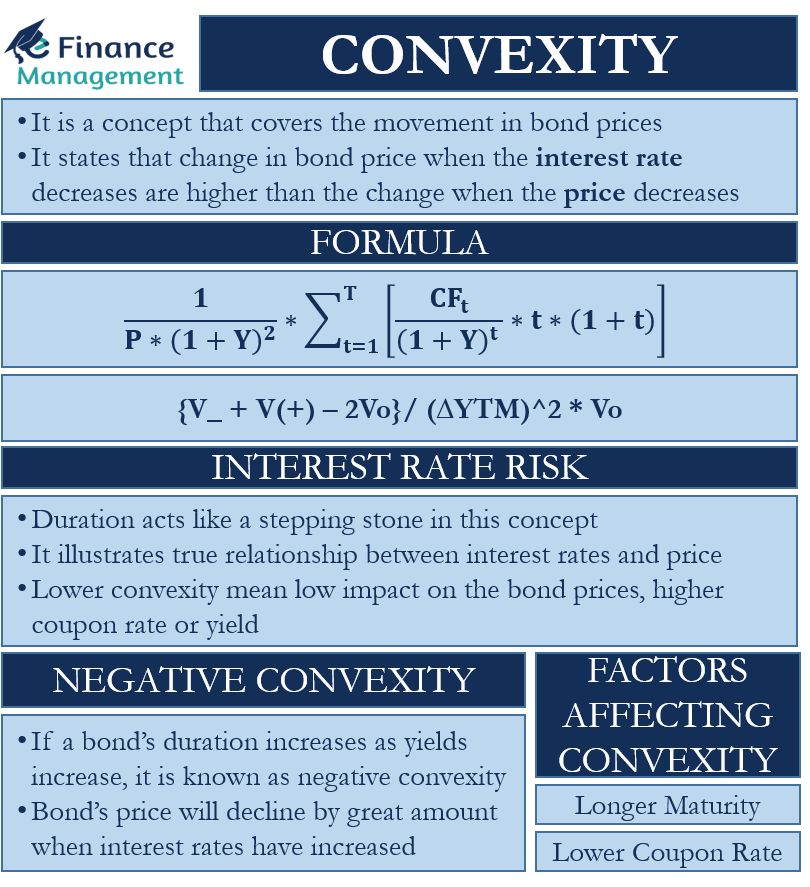

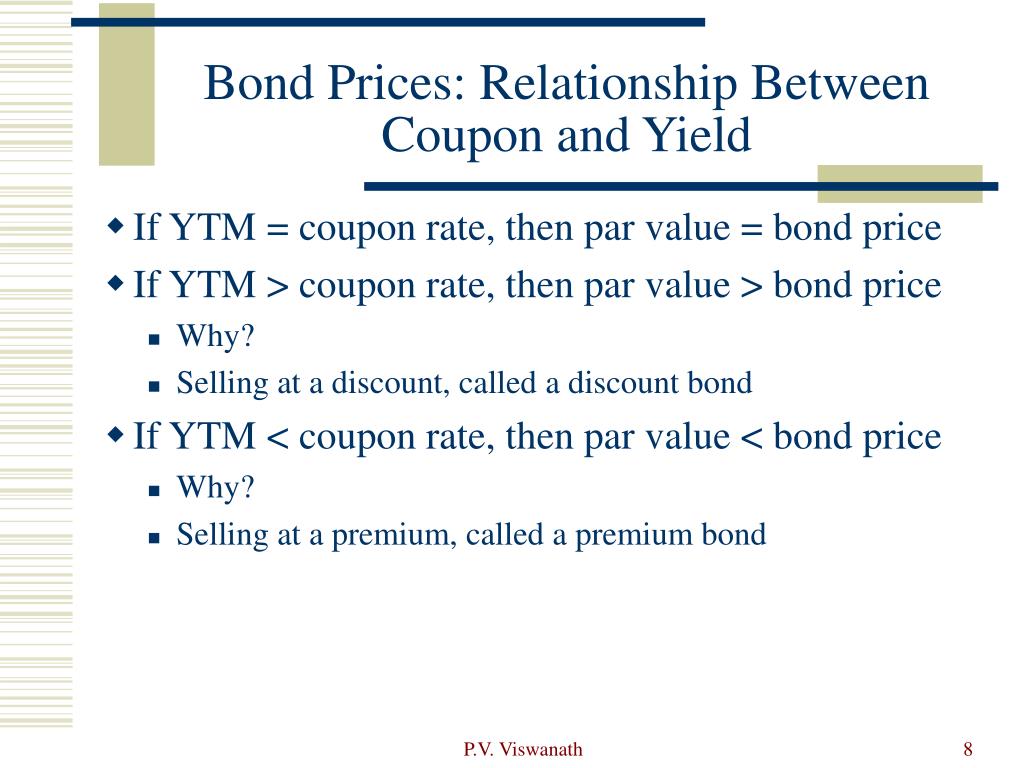

Institutional - Treasury Notes The price of a fixed-rate security depends on the relationship between its yield to maturity and the interest rate. If the yield to maturity (YTM) is greater than the interest rate, the price will be less than par value; if the YTM is equal to the interest rate, the price will be equal to par; if the YTM is less than the interest rate, the ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A... Yield to Maturity vs. Yield to Call: The Difference - Investopedia Yield to maturity is based on the coupon rate, face value, purchase price, and years until maturity, calculated as: Yield to maturity = {Coupon rate + (Face value - Purchase price/years until... Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Where: Price+1%: Bond price when yield increases by 1% Price-1%: Bond price when yield decreases by 1% Price: Current trading price Δyield: Percentage point change in yield (note that it's squared; sign doesn't matter) But – stick with the better convexity formula if you have time to calculate it (or come back and visit this page!).

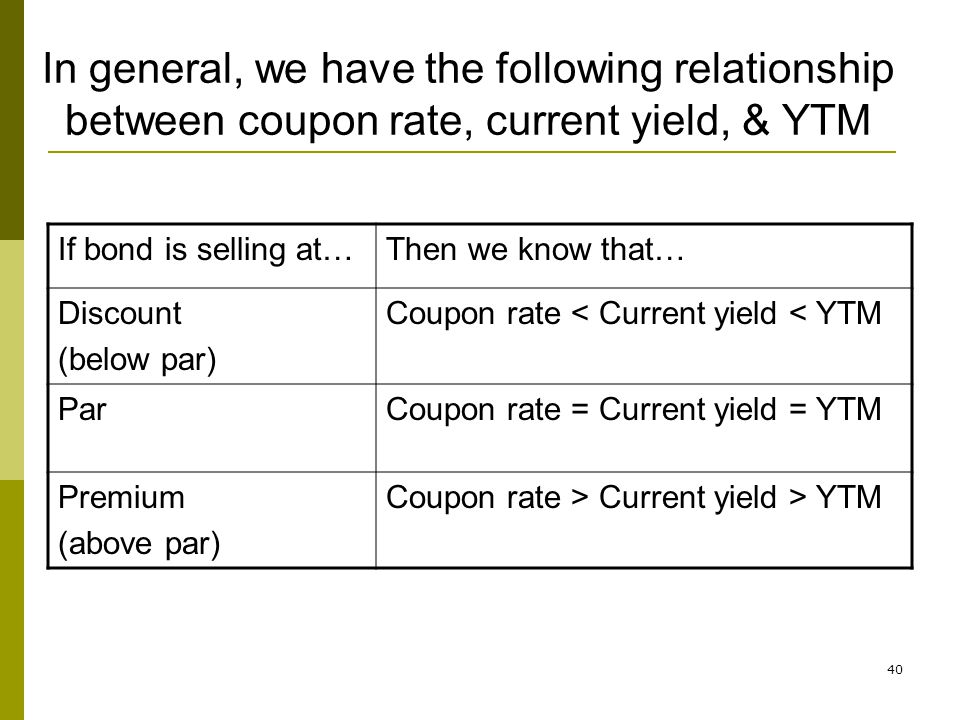

Concept 82: Relationships among a Bond's Price, Coupon Rate, Maturity ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. Relationship between Current Yield Yield to Maturity and Coupon Rate ... See Page 1. Relationship between Current Yield, Yield to Maturity and Coupon Rate The relationship between price, nominal yield, current yield and yield to maturity can be seen in Figure 4.5. When a bond sells at par, its current yield = coupon rate = yield to maturity When it sells at a discount, its yield to maturity > current yield > coupon ... Relationship Between Yield To Maturity and Coupon Rate - LiquiSearch Current Yield - Relationship Between Yield To Maturity and Coupon Rate Relationship Between Yield To Maturity and Coupon Rate The concept of current yield is closely related to other bond concepts, including yield to maturity, and coupon yield. When a bond sells at; a discount: YTM > current yield > coupon yield Understanding Coupon Rate and Yield to Maturity of Bonds Let's see what happens to your bond when interest rates in the market move. When bonds are initially issued in the primary market, the Coupon Rate is based on current market rates, hence YTM is equal to the Coupon Rate. In the example bond above, when you bought the 3-year RTB issued at the primary market, your YTM and Coupon Rate is 2.375%.

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) - YouTube In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield formula, and the...

What Is Bond Yield? - Investopedia May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ...

How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow May 06, 2021 · Yield to Maturity (YTM) for a bond is the total return, interest plus capital gain, obtained from a bond held to maturity. ... Estimate the interest rate by considering the relationship between the bond price and the yield. ... Since we know that the coupon rate is 5 percent, we can start by plugging numbers that are higher than that into the ...

Relationship Between Coupon Interest Rate And Ytm Set in Bandung, which is approximately 2 hours drive from Jakarta and features a comfortably cooler climate than relationship between coupon interest rate and ytm most Indonesian cities, the Hilton Bandung hotel is only a short drive to the many dining and entertainment options at nearby Paris Van Java. Puerto de la Cruz was once a retreat for ...

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "40 relationship between coupon rate and ytm"